Basic Views

As a producer of a variety of premium mushrooms, Yukiguni Maitake and its group companies are working together to build a strong business platform to support the healthy diet of people in Japan and overseas.

To achieve sustainable enhancement of corporate value through management with a sense of responsibility to all of our stakeholders, including shareholders, customers, employees, business partners and local communities, we believe that it is essential to build mechanisms for timely and accurate decision-making and action that can respond to global needs and increase the efficiency and soundness of management.

To that end, we recognize that strengthening of corporate governance is an important management priority and are working to 1) expedite decision-making, 2) enhance the management oversight function, 3) improve management transparency and 4) establish corporate ethics.

We will continue to fulfill our social responsibilities based on safety and security. At the same time, we will strive to meet the expectation of our stakeholders by optimizing the health-promoting benefits of mushrooms endowed by nature and ensuring strict quality management and stable production through the technologies developed by our people to achieve sustainable growth and coexistence with bountiful nature.

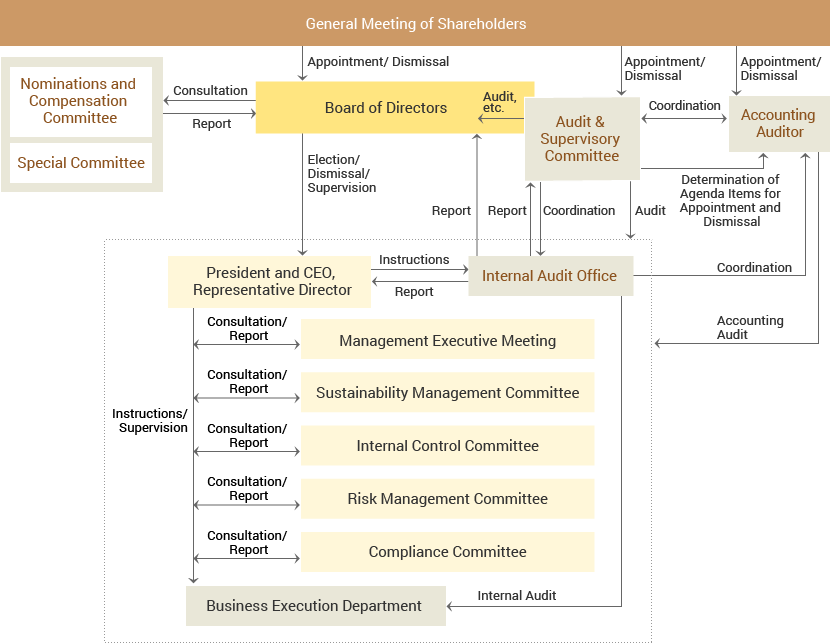

System

Overview of Our Corporate Governance System

Yukiguni Maitake shifted to a company with the Audit and Supervisory Committee by resolution of the 5th Ordinary General Meeting of Shareholders held on June 24, 2022. Our corporate governance system is enhanced with additional supervisory function within the Board of Directors by assigning the members of the Committee who are responsible for auditing and supervising the activities of Directors to the Board of Directors and giving them the voting rights. This mechanism enables speedy and responsive management because the Directors can be entrusted to make important decisions regarding execution of business.

We believe this promotes more transparent, fairer, speedier, and bolder decision-making process and ensures an ever more powerful system that strongly supports management decisions.

Corporate Governance Structure

Board of Directors

The Board of Directors is chaired by President & CEO. In principle the Board of Directors meets once a month. The Board of Directors deliberates and makes decisions on management policies and material matters regarding execution of business, and fulfills its role in supervising business execution. The Board of Directors is comprised of eight Directors. To ensure decision-making from a broader perspective and objective supervision of business execution, two out of the five Directors (excluding Directors who are Audit and Supervisory Committee Members) are Outside Directors and two out of the three Directors who are Audit and Supervisory Committee Members are Outside Directors, in the Board of Directors.

Audit and Supervisory Committee

The Audit and Supervisory Committee meets once a month in principle and is held at any time as necessary. All Audit and Supervisory Committee members participate in the Board of Directors meetings. A full-time Audit and Supervisory Committee member participates in the Management Executive Meeting as an observer and confirms the process of important decision-making and the execution of business by browsing internal approval documents to grasp the situation of the company. In addition, the full-time Audit and Supervisory Committee member participates in major committees such as the Sustainability Promotion Committee, the Internal Control Committee, the Risk Management Committee and the Compliance Committee as an observer, confirms compliance with rules and regulations, the Articles of Incorporation, internal rules, etc. and response to assumed risks, and expresses opinions to the executors as appropriate.

Audit and Supervisory Committee members who are Outside Directors fulfill management supervisory functions from an objective viewpoint based on an outside viewpoint through grasping important management information. In order to further increase the independence and neutrality of audits by the Audit and Supervisory Committee, two out of the three Audit and Supervisory Committee members are Outside Directors.

In addition, the Audit and Supervisory Committee receives reports on internal audit work at least once every two months in principle from the Internal Audit Office and exchanges opinions as appropriate. This committee exchanges opinions with Accounting Auditor as appropriate at financial briefings once every three months in principle and strives to increase the efficiency and effectiveness of audits by the Audit and Supervisory Committee. Furthermore, the Audit and Supervisory Committee exchanges opinions with President & CEO once every three months in principle and shares information and consults on company-wide issues, important audit issues and others.

Nomination and Compensation Committee

In order to enhance the transparency and objectivity of the deliberation process in the executive personnel and compensation systems, the Company has established a voluntary Nomination and Compensation Committee as an advisory body to the Board of Directors. The committee consists of at least three members selected from among the directors of the Company, and the majority of the committee members are outside directors who have been registered as independent directors with the Tokyo Stock Exchange. The chairperson of the Committee is selected from among the independent outside directors.

In response to consultations from the Board of Directors or the President & CEO, Representative Director, the Nomination and Compensation Committee mainly confirms the appropriateness of the process of selecting candidates for Directors (excluding Directors who are Audit and Supervisory Committee Members), with respect to nomination, and reports back to the Board of Directors. In addition, the Committee shall hold discussions regarding the enhancement of the succession plans for CEO and others and make recommendations from an objective standpoint. As for the details of individual compensation for Directors (excluding Directors who are Audit and Supervisory Committee Members), the Committee shall confirm the appropriateness of compensation amounts through monitoring on its conformity with the Company’s compensation determination policy and compensation determination process, and comparison of commpensation levels wtih those of other companies, and report the matter to the Board of Directors. In the fiscal year ended March 31, 2023, the Committee met a total of five times.

Special Committee

From a viewpoint of protecting the interests of minority shareholders, the Special Committee comprised of Independent Outside Directors has been established pursuant to the Corporate Governance Code. In this Committee, deliberation and investigation on material transactions and actions with controlling shareholders as well as validation of ongoing transactions with them are conducted once a year and reported to the Board of Directors to protect minority shareholders.

Management Executive Meeting

The Management Executive Meeting is chaired by President & CEO, Representative Director, and is comprised of other full-time Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive Officers. In principle, it is held once a week and deliberates management plans, management control, management improvement measures, corporate governance system and other material matters related to management. A full-time Audit and Supervisory Committee member attends the meeting as an observer.

Sustainability Management Committee

In order to promote the sustainable growth of the entire group and initiatives to resolve social issues such as climate change-related risks, a Sustainability Promotion Committee has been established to deliberate and manage the important issues of sustainability in the Yukiguni-Maitake Group and its initiatives to achieve sustainable growth and resolve social issues. The committee deliberates and manages the important sustainability issues of the Yukiguni Maitake Group, sustainable growth, and efforts to resolve social issues.

The Sustainability Management Committee is chaired by President & CEO, Representative Director, and is comprised of other full-time Directors (excluding Directors who are Audit and Supervisory Committee Members), Executive Officers, pursuant to the Rules for the Sustainability Management Committee. In principle, the Sustainability Management Committee meets once every half year. In addition, a full-time Audit and Supervisory Committee Member attends the meeting as an observer, and Group company presidents and others attend the meeting as necessary, as designated by the chairperson of the Committee.

Internal Control Committee

For the purposes of strengthening a system to ensure the appropriateness of financial reports and improving and strengthening group control environment, the Company has established the Internal Control Committee. This committee deliberates, operates and administrates an internal control policy, developing the structure of administrative base regarding internal control, prevention measures regarding internal control and other important matters relating to internal control at Yukiguni Maitake Group. The Internal Control Committee is chaired by President & CEO, Representative Director, and is comprised of other full-time Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive Officers pursuant to the Rules for the Internal Control Committee. In principle, the Internal Control Committee meets once every quarter. In addition, a full-time Audit and Supervisory Committee Member attends the meeting as an observer.

Risk Management Committee

The Risk Management Committee has been established for the purpose of enhancing the risk management system and operating and managing company-wide risk management.

The Risk Management Committee is chaired by President & CEO, Representative Director, and is comprised of other full-time Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive Officers, pursuant to the Risk Management Regulations. In principle, the Risk Management Committee meets twice a year. In addition, a full-time Audit and Supervisory Committee Member attends the meeting as an observer, and Group company presidents and others attend the meeting as necessary, as designated by the chairperson of the Committee.

Compliance Committee

The Compliance Committee has been established to deliberate on compliance-related matters and verify responses, and is working to enhance Compliance Management.

The Compliance Committee is chaired by President & CEO, Representative Director, and is comprised of other full-time Directors (excluding Directors who are Audit and Supervisory Committee Members) and Executive Officers, pursuant to the Compliance Regulations. In principle, the Compliance Committee meets four times a year. In addition, a full-time Audit and Supervisory Committee Member attends the meeting as an observer, and Group company presidents and others attend the meeting as necessary, as designated by the chairperson of the Committee.

Internal Audit office

To strengthen our internal control system, we established Internal Audit Office that directly reports to President & CEO. It carries out internal control based on the audit plan. The office is comprised of three members, including an office head.

Internal Control System

As a system to ensure transparency and fairness in corporate management, we have established the Basic Policies for the Internal Control System and are operating the internal control system based on it.

For more details on our corporate governance system, please refer to the Securities Report and the Corporate Governance Report.

Indicators

| Unit | FY2020 | FY2021 | FY2022 | |||

|---|---|---|---|---|---|---|

| Directors | In-house | Male | people | 3 | 5 | 4 |

| Female | people | 0 | 0 | 0 | ||

| Total | people | 3 | 5 | 4 | ||

| Outside (independence) |

Male | people | 0 | 0 | 2(2) | |

| Female | people | 2(2) | 2(2) | 2(2) | ||

| Total | people | 2 | 2 | 4 | ||

| Total | people | 5 | 7 | 8 | ||

| Ratio of Independent Outside Directors | % | 40 | 29 | 50 | ||

| Ratio of Female Directors | % | 40 | 29 | 25 | ||

* As we shifted to a company with the Audit and Supervisory Committee in June 2022, Directors who are Audit and Supervisory Committee Members are included in the results in and after FY2022.

| Unit | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| Number of the Board of Directors meetings held | times | 19 | 17 | 17 |

| Average attendance rate at Board of Directors meetings | % | 99.5 | 99.5 | 100 |

| Number of the Audit and Supervisory Committee meetings held* | times | 13 | 14 | 13 |

| Average attendance rate of the Audit and Supervisory Committee meetings | % | 100 | 98.2 | 97.4 |

* As we shifted to a company with the Audit and Supervisory Committee in June 2022, the results related to the Board of Corporate Auditor are shown, regarding FY2020 and FY2021.

Initiatives

Analysis and evaluation of the effectiveness of the Board of Directors and its results

Summary of the Results of Evaluation of the Board of Directors

For the purposes of further increasing the effectiveness of the Board of Directors, we had a third-party organization conduct questionnaires to all Directors (8 members) consisting of the Board of Directors and interviewed with Outside Directors in March 2023 and analyzed and evaluated them.

With respect to the items of evaluation such as (1) the role and function of the Board of Directors, (2) the composition and scale of the Board of Directors, (3) the operation of the Board of Directors, (4) communication with the management, (5) coordination with audit organizations, and (6) relationship with shareholders and investors, we reported the results of analysis and evaluation to the Board of Directors and shared issues and problems identified and discussed future measures.

The results were generally positive, and the Board of Directors evaluated that it was properly operated and that its effectiveness was ensured.

In addition, with respect to issues acknowledged we will work for further improvement.

Compensation for Directors and Corporate Auditors

Disclosure of Policy on Determining Compensation Amounts and Calculation Methods

As of September 17, 2020, the voluntary Nomination and Compensation Committee was established as an advisory body to the Board of Directors and Representative Director regarding the policy for determining individual compensation for Directors and the process of the determination. The committee deliberates and confirms the process of selecting Director candidates and the policy for determining the compensation, which are the resolutions of the Board of Directors and the General Meeting of Shareholders, and submit reports.

At the Board of Directors meeting held on May 19, 2022, the following resolutions were made as a policy for determining the amount of compensation, etc. for Directors.

1. Basic policy for compensation

The basic policy for compensation for Directors of the Company has the criteria of a compensation system linked to performance, employee salary levels, etc. for each fiscal year in order to fully function as incentives striving for the sustainable increase of corporate value. The basic policy for determining compensation for Directors on an individual basis has the criteria of an appropriate level based on their position and roles.

In particular, the compensation for Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) comprises basic compensation as fixed compensation and performance-based compensation as variable compensation. With regard to Outside Directors and Directors who are Audit and Supervisory Committee Members, the Company pays them basic compensation only.

2.Policy for determining the amount of compensation, etc. on an individual basis of basic compensation (including policy for determining the timing or conditions of the payment of compensation, etc.)

The basic compensation for Directors (excluding Directors who are Audit and Supervisory Committee Members) of the Company shall be monthly monetary compensation and be determined taking into comprehensive consideration based on the Company’s performance, another companies’ compensation levels, the Company’s employees’ salary levels, Executive Officers’ compensation levels and other factors according to posts, roles, terms of office, etc.

The basic compensation for Directors who are Audit and Supervisory Committee Members of the Company shall be determined after consultation among all Directors who are Audit and Supervisory Committee Members also in consideration of their duties and various circumstances including recent economic climate.

3.Policy for determining the details and method calculating the amount of performance-based compensation (including policy for determining the timing or conditions of the payment of compensation, etc.)

Performance-based compensation payable to Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) comprises performance-based bonuses (monetary compensation) reflecting KPI, a performance indicator, and stock compensation (nonmonetary compensation) for the purpose of increasing corporate value over the mid- to long-term and sharing value with shareholders, in order to enhance their awareness of improving performance for each fiscal year.

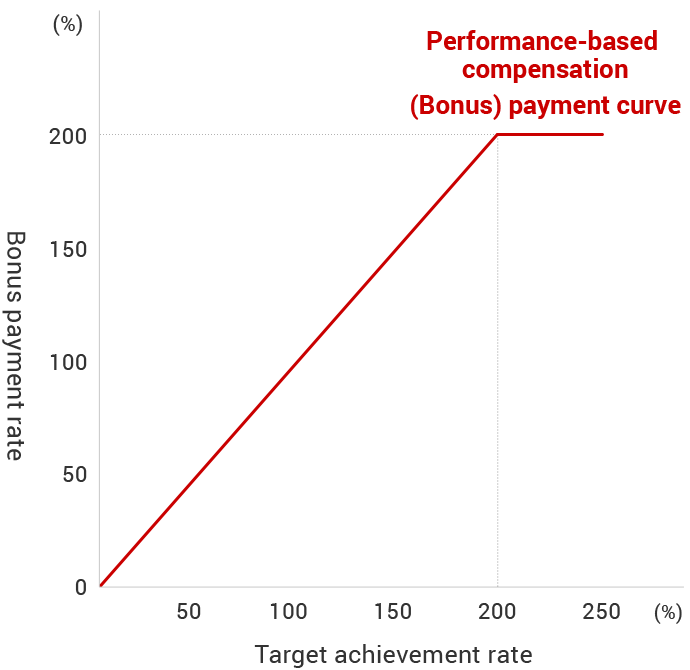

i) Performance-based bonuses (monetary compensation)

The Company shall pay an amount calculated according to the degree of achieving a target for Core EBITDA for each fiscal year and a figure for the previous fiscal year as a bonus at the predetermined times every year. The target shall be set at the time of forming a plan in order to adjust profit planning for each fiscal year based on a performance indicator and its figure set in the midterm business plan and be reviewed appropriately based on a report from the Compensation and Nomination Committee according to environmental change.

ii) Stock compensation (nonmonetary compensation)

The Company shall grant its common stock after setting the predetermined Transfer Restriction Period and grant its common stock every year in principle in the number determined according to their positions after conclusion of agreements on the allotment of the Shares with Restriction on Transfer between the Company and Eligible Directors.

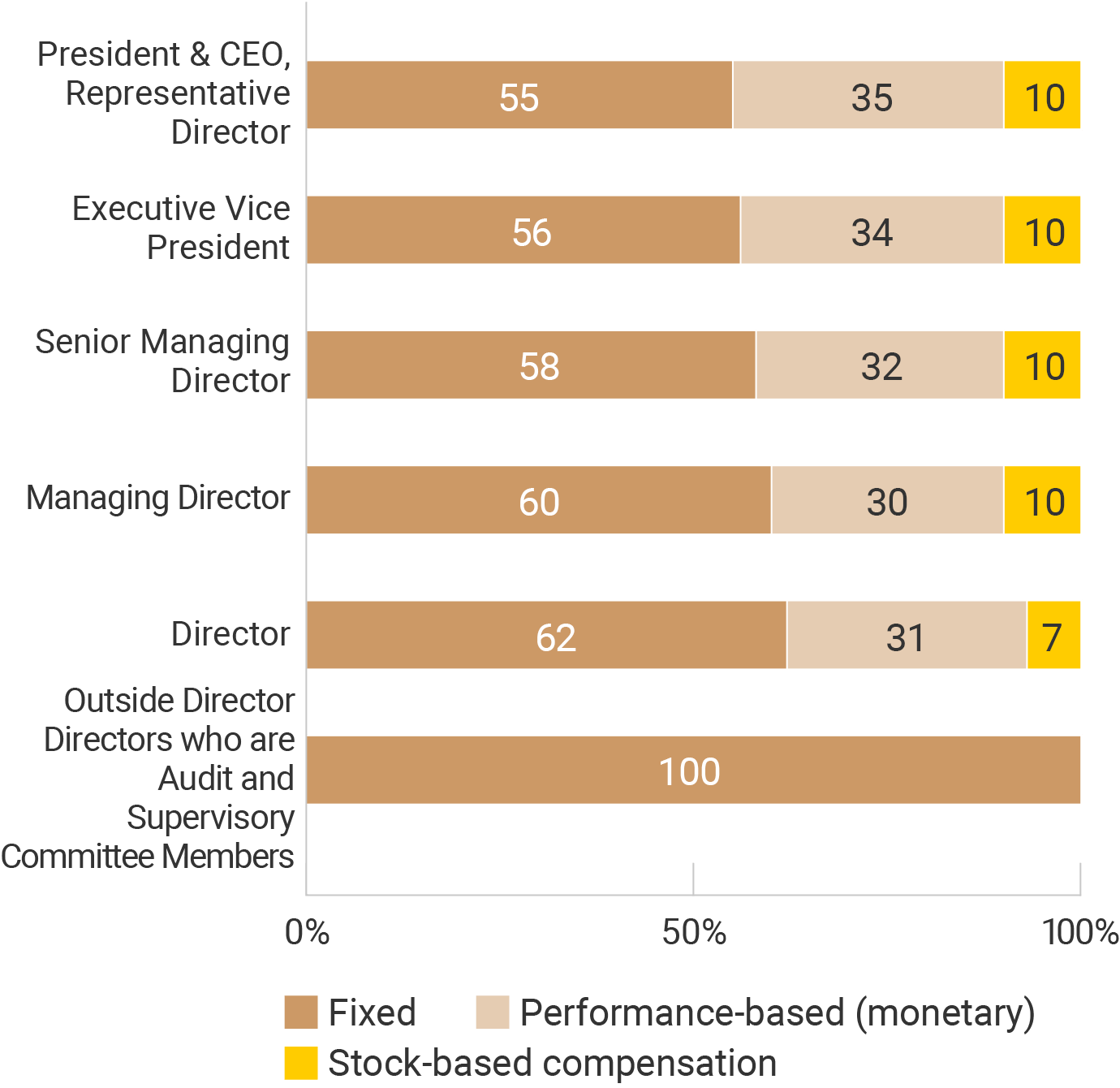

4.Policy for determining the percentage of compensation by type for Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members)

The percentage of compensation by type shall be composed to increase the weight of performance-based compensation in proportion to the superior positions based on the compensation level of companies on the same level of business size with the Company and belonging to the relevant types and categories of business as a benchmark. In addition, with regard to stock compensation, the weight of the superior positions increases in the same manner as above because the superior positions should contribute to increasing corporate value over the mid- to long-term.

Based on the above, the Company forms the percentage of compensation by type and inquires it of the Compensation and Nomination Committee. The Board of Directors shall respect the details of a report from the Compensation and Nomination Committee and determine the details of compensation, etc. for Directors on an individual basis within the range of the percentage of compensation by type presented in the report. With respect to the estimated percentage of compensation by type for Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members), performance-based compensation is roughly 45% (specifically the percentages set for performance-based bonus and stock compensation are 35% and 10%, respectively; if KPI is achieved 100%, the percentages set for basic compensation, performance-based bonus, and stock compensation are roughly 55%, 35%, and 10%, respectively.) in the case of Representative Director.

5.Matters relating to determining the details of compensation, etc. for Directors on an individual basis

With respect to the amount of compensation, etc. for Directors (excluding Directors who are Audit and Supervisory Committee Members) on an individual basis, Representative Director shall be delegated its specific details based on the policy by resolution of the Board of Directors’ meeting within the range of the total amount of compensation approved at the General Meeting of Shareholders. The details of authorization shall be the evaluation and distribution of performance-based compensation based on the amount of basic compensation for each Director and the degree of contribution to a role expected from each Director according to the policy for determining compensation. Representative Director delegated as above shall inquire the original plan of the Compensation and Nomination Committee and receive a report from it and must determine the compensation, etc. for Directors on an individual basis based on the details of the report, in order to guarantee that the authority has been exercised appropriately.

The amount of compensation for Directors who are Audit and Supervisory Committee Members on an individual basis shall be determined after consultation among Directors who are Audit and Supervisory Committee Members within the range of the total amount of compensation approved at the General Meeting of Shareholders.

The respective percentages of basic compensation as fixed compensation and performance-based compensation by position and the correlation between the Company’s bonus payment rate and the target achievement rate are shown below.

Results

| FY2020 | FY2021 | FY2022 | ||

|---|---|---|---|---|

| Directors (excluding Directors who are Audit and Supervisory Committee Members and Outside Directors) | Total amount of compensation (millions of yen) | 49 | 72 | 63 |

| Number of Directors and Outside Corporate Auditors covered (people) | 2 | 4 | 4 | |

| Directors: Directors who are Audit and Supervisory Committee Members (excluding Outside Directors) | Total amount of compensation (millions of yen) | - | - | 12 |

| Number of Directors and Outside Corporate Auditors covered (people) | - | - | 1 | |

| Corporate Auditors (excluding Outside Corporate Auditors) | Total amount of compensation (millions of yen) | 13 | 15 | 3 |

| Number of Directors and Outside Corporate Auditors covered (people) | 1 | 1 | 1 | |

| Outside Directors and Outside Corporate Auditors | Total amount of compensation (millions of yen) | 31 | 40 | 41 |

| Number of Directors and Outside Corporate Auditors covered (people) | 5 | 5 | 7 |

(Notes)

- 1.The number of persons paid compensation above does not include one director who is not paid compensation.

- 2.Two directors (excluding Directors who are Audit and Supervisory Committee Members) and two corporate auditors (all outside corporate auditors) who retired at the conclusion of the 5th Ordinary General Meeting of Shareholders held on June 24, 2022, are included.

- 3.We shifted from a company with a Board of Corporate Auditors to a company with an Audit and Supervisory Committee on June 24, 2022. The amounts paid to Corporate Auditors are the amounts for the period before the shift to a company with an Audit and Supervisory Committee, and the amounts paid to Directors who are Audit and Supervisory Committee Members are the amounts for the period after the shift to a company with an Audit and Supervisory Committee.

- 4.The total amount of non-monetary compensation paid to Directors (excluding Directors who are Audit and Supervisory Committee Members and Outside Directors) consists of 4 million yen in compensation in the form of restricted stock.

- 5. We make the number of directors consistent with that stated in the notice of convocation (business report), and therefore may not be consistent with the actual number of directors.

For details on our corporate governance, please refer to the Annual Securities Report and the Corporate Governance Report.

We have implemented the principles of the Corporate Governance Code.